Insurtech

04 September 2017 | 7 min read

We’d like to meet you

What exactly is insurtech?

What exactly is insurtech?

Inspired by the term "fintech," insurance technology, or insurtech, refers to the application of technology in the insurance industry to drive new products and solutions, improve efficiency of processes and operations, and enhance customer experience and satisfaction. Wearables, connected devices, artificial intelligence, blockchain and data analytics are just some examples of insurtech.

Insurtech can completely transform how we buy insurance, how policies are priced and how claims are made in the next five to ten years.

A game changer for Asia’s insurers

A game changer for Asia’s insurers

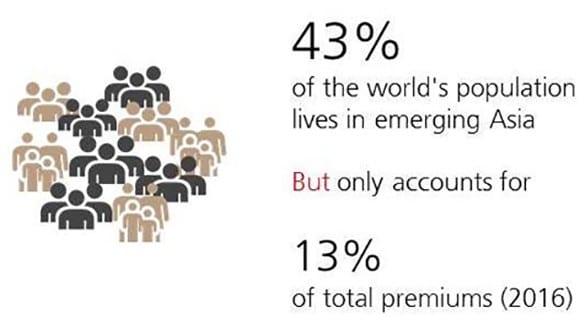

Asia is one of the most underpenetrated insurance markets in the world, as its large populations and geographical dispersions render most traditional distribution models costly and inefficient.

However, insurtech is set to transform the industry and region. Artificial intelligence and digital distribution channels will make insurance policies more affordable and much easier to purchase. Connected devices and advanced data analytics, meanwhile, should result in more accurate risk assessment and pricing and improved customer experience and satisfaction.

Through advances in insurtech and the mainstream adoption of new technologies, CIO estimates the total cost savings for Asia’s insurance industry could be around USD 300bn per year by 2025.

Opportunities and challenges

Opportunities and challenges

Mobile penetration is rising in Asia

Mobile penetration in Asia Pacific will rise to 75% by 2020 (source: GSMA), an increase of 460m unique subscribers, with India, the Philippines, and Indonesia in the forefront. The mobile channel will become a critical gateway for insurers to raise awareness, educate customers, distribute products and provide services.

Rising influence of the millennial generation

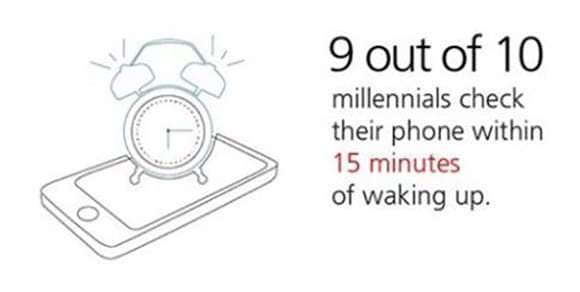

Millennials (born between 1982 and 1998) are more comfortable with new technology and more willing to share personal information in exchange for convenience, financial incentives or more personal services (source: Columbia Business School and Aimia).

1.5 million jobs at risk in Asia

Like all technology-driven shifts, insurtech will incur costs to employment: CIO believes 1.5 million jobs in Asia’s insurance industry are at risk of being made redundant by new technological applications in the medium term.

Legacy IT platforms

On the execution side, the main challenge is the fact that most Asian insurers have legacy and decentralized IT systems that do not support the functionalities required for a fully online, streamlined insurance purchase and servicing platform. It could easily take months to transform legacy systems into cutting-edge IT platforms required by modern insurtech functionalities.

Customers to win big

Customers to win big

Customers will be the biggest winners of insurtech, benefitting from better services, greater convenience, cheaper premiums and more personalized solutions. Incentive-based products could encourage healthier lifestyles and safer driving, which could yield significant benefit to society as a whole.

The report also features insights from industry veterans and pioneers – they too see insurtech’s rise as inevitable and largely beneficial to both insurers and their customers. Read the report to find out more.

Other articles you might like

Other articles you might like

For more detail download the full report

If you want to know more

If you want to know more

Come and see us so we can find out more about what matters to you