Watch the webinar for business owners considering an exit.

Coming off an active market for mergers and acquisitions, the latest UBS Investor Watch looks at business owners who now face headwinds from higher interest rates, inflation and political uncertainty. We spoke with owners considering an exit and those who recently sold their business.

Among current business owners, we found that many fear they missed their best chance to sell. But experts advise that opportunities still exist and the key to attracting the right buyer is to plan ahead. As for business owners who recently sold, most wish they’d taken more time to prepare. They’d agree: start planning now to be ready when the winds shift and opportunity arrives.

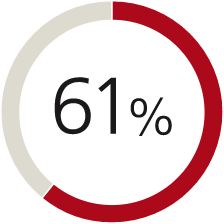

Business owners are concerned about valuations in the current market

Many worry about getting a fair price …

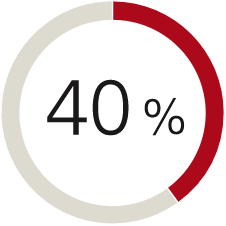

… and regret not selling sooner

Highly concerned about a lower business valuation in current economy

Regret not trying to sell or exit business sooner

How they intend to exit

23%

- Strategic buyer

21%

- Private equity

10%

- IPO

17%

- Partner or management

13%

- Next generation

6%

- Employee Stock Ownership Plan: (ESOP)

Expert insight

Are you exit ready? Sign up and we’ll help you take a realistic look at where you stand today

“While the macroeconomic environment is weighing on overall M&A activity, there continues to be a bid for high-quality, resilient, cash flowing businesses.

Advanced preparation is key for taking advantage of future market windows.”

Oliver Henderson, Managing Director, OneBank Coverage, UBS Investment Bank

They have not taken steps to sell …

34%

- Have not identified professionals to help finalize the sale

34%

- Have not put structures in place to help minimize taxes and shield proceeds

31%

- Have not completed a business valuation

… or transfer their newfound wealth

40%

- Have not engaged heirs in dialogue about family wealth

37%

- Do not have an estate plan

31%

- Have not identified a plan for what to do with the proceeds

And business owners who sold underestimated the time needed to prepare

Most spent less than two years preparing for the sale …

% who agree

- 0 %

Spent two years or less preparing to sell their business

32% Less than 1 year

41% 1-2 years

… and a vast majority regretted not preparing sooner

- 0 %

Wish they had spent more time preparing for a sale

Expert insight

Sign up to get our guide: Planning for the sale of a closely held business

“Before engaging an investment banker or soliciting interest, educate yourself on potential tax strategies. Decide whether any ownership interests should be transferred to family or charity so they can also benefit from the transaction.

As for timing, the earlier the better. We often work with clients years before a transaction to get them, their businesses and families prepared for a sale.”

Ann Bjerke, Managing Director, Head of UBS Advanced Planning

When selling, business owners consider more than just the sale price

Business owners have concerns beyond the sale

% worried when giving up ownership

87%

- Buyer won’t treat employees well

85%

- Won’t have as much of a sense of purpose

84%

- Don’t agree with direction buyer will take the business

But they look forward to new opportunities

% greatly look forward to the following

73%

- Traveling and spending time with friends and family

52%

- Start a new business venture

45%

- Giving back to community or charitable causes

Expert insight

Learn how business owners who successfully transitioned to life after the sale of their business

“A successful post-sale road map often requires owners to redefine their purpose as well as roles and responsibilities for themselves and family who will be involved in new philanthropic or entrepreneurial pursuits.”

Heather George, Executive Director/Senior Strategist, UBS Family Advisory & Philanthropy Services Americas

Most business owners who recently sold sought advice from their financial advisor

Who they turned to

66%

- Financial advisor

35%

- Accountant

33%

- Lawyer

32%

- Family

28%

- Business broker

Expert insight

Thinking about selling your business? Sign up for our three-point plan

“For many business owners, their business encompasses how they spend their time, their social lives and purpose.

Talking about these factors with an advisor when constructing a financial plan is integral in getting emotionally and financially ready for life after a business.”

James Jack, Divisional Sales Manager, UBS Private Wealth Management Division (East)

It’s never too early to plan, but it can be too late, especially to maximize net proceeds. Strategic planning and tailored solutions, including financial and investment banking expertise, can help throughout the lifecycle of a business.

With the right guidance, business owners can proceed with passion and exit on their terms, embracing their future with new enthusiasm.